What You Need to Know

| Does the IRS Provide Any Assistance to Employees?

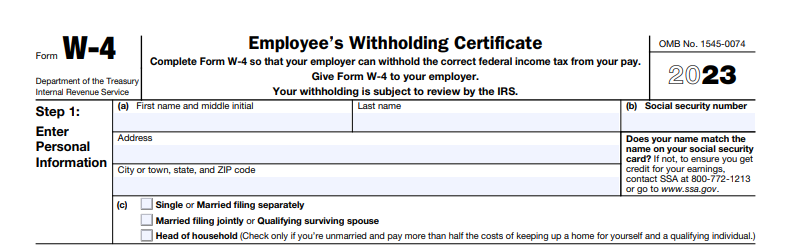

The IRS suggests using the Tax Withholding Estimator available at this URL: www.irs.gov/W4app It will provide the most accurate withholding information and information on how to best complete Form W-4. What Are the Steps to Completing the Form W-4 (2023) Step 1: Complete the Personal Information fields for name, address, and filing status

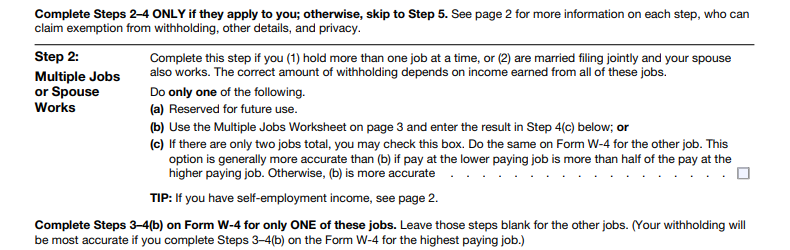

Step 2: This Step is for employees with more than one job and/or those who are married filing jointly and their spouse also works. Standard deduction and tax brackets will be divided equally between all jobs.

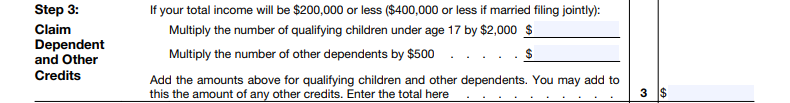

Step 3: Employees with qualifying dependents and/or children should complete this step. The employee will calculate the dollar amount for the appropriate deductions – tax credit.

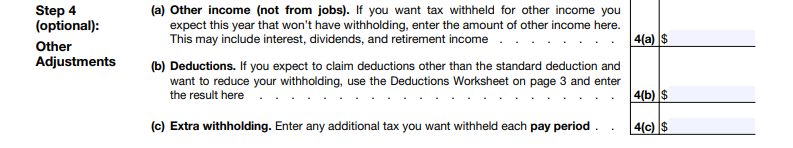

Step 4: This step enables employees to calculate optional and/or other adjustments. Examples may be an employee who wants tax withheld for other income for which federal withholding is not taken, or the employee may want to claim deductions other than the standard deduction. Also, an employee may simply request additional withholding each pay period.

Step 5: Sign and Date. The W-4 form will be invalid if it is not signed and dated.

How Does an Employee Determine if He or She is Exempt From Withholding?

How is Primepoint Helping Customers with the Form W-4 (2023)? The Hire Wizard in Primepoint’s system will accommodate the Form W-4 (2023) in addition to continuing to accommodate the old Form W-4. When adjusting withholding for an existing employee the system will ask if the employee filed out a Form W-4 (2023). If yes, the system will open up the fields for the appropriate calculations. The system will have attributes for the Form W-4 (2023) within the Federal tax group. Primepoint will be using the Percentage Method Tables for Automated Payroll Systems to calculate federal withholding. In addition, clients using Primepoint’s onboarding technology can have their employees fill out an electronic version of the W-4 during the onboarding process which will automate some of the complexity in the form. |